Last Updated on November 23, 2022 by Chris and Lindsay

If you’re thinking about RVing full-time but aren’t sure where to start, we’ll get the ball rolling in this post by sharing all the financial tips before RVing that we think you should do before hitting the road.

RVing for any amount of time is such a rewarding experience. We’ve been full-time RVing since March 2018 and we are so addicted to the lifestyle now that we tell people that we are willing to do virtually anything (legal!) to keep ourselves on the road.

If you haven’t checked it out yet, we’ve got a great post that breaks down how we live on less than $2,000 per month that will show you dollar-for-dollar how committed we are to living as frugally as possible so we can stay on the road as long as possible.

But starting out on your journey to full-time RVing can seem daunting with all the things you probably feel you need to do before you hit the road.

And, if you’re not careful, you may be thinking about what you should do if you turn the wrong way on a one-way street with your towed vehicle attached to your motorhome. Or you may be wondering how long you can go boondocking between dumping your tanks and refilling your fresh water and grocery stock.

But really, the first things you should be thinking about are the financial pieces of the full-time RVing finance puzzle that absolutely must be addressed sooner than later. Even before you purchase your RV or take it out for a long weekend stress-testing it, you’ve got a few things to do to get your ducks in a row.

As little as we knew about RVing the first day we hit the road, we did have the following recommendations in place in our own lives. And to this day we live by these principles.

That said, let’s get into the things you absolutely must do before going full-time in your RV.

Financial Tips Before RVing Full-Time

Just as a house or building begins with a foundation, the following items we address are the financial foundation for your full-time RVing dreams. Many of them are sequential, so see them as stepping stones guiding you along your journey.

But make no doubt, if you don’t take your financial foundation prior to committing to the road, you will find the learning curve will cost you tremendously, quite literally.

1) Set aside a $1,000 “Emergency Fund” in your primary checking account.

According to the Motley Fool, nearly 70% of Americans could not withdraw $1,000 from their bank account in the event of an emergency. Further, 6 in 10 Americans claimed they do not have any savings at all in their bank account.

I used to call this $1,000 my “overdraft” fund, back when I was writing more checks than I was swiping my debit or credit card. Emerging from the days of overdraft fees, I developed a paranoia about ever having to talk to a bank ever again about the dreaded topic.

With fees ranging from $10-$25 per transaction, I found myself wasting hard-earned dollars on fees I could very well avoid if I kept track of my spending a little better.

So in conjunction with setting up my own personal bookkeeping system, I also made it a priority to ensure that I ALWAYS had adequate money in my checking account specifically earmarked for my own personal protection.

Adequate started at $50. But then I quickly found it was better to have $500 in the account for the times I am surprised by having to purchase 4 new tires or have an unexpected filling at the dentist.

Eventually, I just rounded up to $1,000 and for nearly 15 years I have never had less than $1,000 in my primary checking account, which I could access with the swipe of a card or filled-out check.

This principle is good practice for life in general, let alone if you are preparing to RV full-time. The very first thing you need to do is to give yourself some breathing room in the event of a crisis.

2) Get out of debt.

Depending on how much you owe and at what interest rates you are paying, getting out of debt can be a simple thing or a complicated one. It also depends on how motivated you are to live debt-free.

When I emerged from bankruptcy at the age of 29 I swore I would treat my money differently. With a little help from the collapse of the economy in 2007-2008, I overleveraged my ability to buy and maintain property and underestimated my inclination to pick up more than my share of bar tabs.

After mourning the loss of my first financial life, I was greeted with the hope that I could do things differently in my second financial life. And I did. Starting with 0 debt, I committed to accruing no more debt at all. Long story short, for over a decade I have kept my word to myself.

There are a few competing philosophies about how to address debt. The simplest is to list all of your debts in order of the interest rate and then work hard to address that debt.

Make the minimum payments on all but the highest interest rate debt and throw all you can at it. Then once that one is paid off, do the same for the next highest debt. And so on.

This is called the debt avalanche and is fairly easy to organize and follow yourself.

However you decide to address your debt, do so diligently. Life on the road won’t feel free if you’ve got interest payments to make.

3) Budget fairly.

I like to use the word “fair” because you don’t typically see that word in financial settings. Fair is subjective. It is a comparison in your own mind between two things.

So as we recommend that you budget fairly, we mean, cut yourself some slack in some areas and get yourself together a little more in others. Don’t look at your budget as an enemy and try to make it so tight that you fail to treat yourself or your loved one(s) to dinner sometime that month.

Consider each item in your budget and say, “What’s a fair amount for this expense?” Then answer the question both from your previous expenditures on this item and from what your gut says.

We always over-budget nearly each line item in our budget because it gives us the slack to feel relief at the end of the month when we typically come in under-budget.

Don’t get me wrong though. You shouldn’t leave so much room in the budget that you don’t change your lifestyle by making some changes. But don’t budget so tightly that you don’t get to enjoy life a little.

Regardless of how tight our budget is, we always set aside a generous portion for “date night” so that we can relax and enjoy each other.

But this is also where you will want to set aside a fairly aggressive amount to pay down debt if you have any.

4) Consolidate expenses.

In an effort to simplify your finances for when you are RVing full-time you will want to go ahead and consolidate expenses as much as possible. What we mean is, try and wean yourself off of some of the many expenses that are easy to incur when you live in a brick-and-mortar home.

We like to think of this as the “tightening the belt” phase of budgeting and planning. Do you really need all those satellite channels? Do you have the most affordable phone plan available? Insurance? Are there better refinancing rates available?

Look for all the ways that you can consolidate, or generally reduce, your expenses. In some cases that will be removing them entirely. In other cases, it may be switching plans to save a few dollars or turning the thermostat up or down a little bit.

Whatever you can do to both reduce the amount you’re paying and the number of bills you have, the more freedom you will find in full-time RVing.

5) Set aside 3-6 months of short-term savings.

Knowing that you have $1,000 set aside for a quick-access emergency fund and that you budgeted fairly to address debts and provide for a consolidated list of monthly expenses, it’s time to look a little further toward the future.

If you plan to work and/or start or run a business on the road, this principle specifically applies to you. If you are retired, however, you’ve hopefully made the financial decisions that provide you with indefinite financial support.

For those of us working as we go, 3-6 months should be the start of the cushion we build for ourselves in the event our industry tanks, our clients slow down or we face being laid off.

We can’t predict the future. But we can prepare for it.

These short-term savings will be what you can rely on to pay the bills in the event you find yourself without employment. The road can be expensive, so having these savings will give you the peace of mind to know that you have enough time to find other sources of income.

6) Know your cash flow.

If you plan to work on the road, either for an employer or for yourself, it is wise to have a relative understanding of your cash flow. These numbers should be fairly conservative when estimating revenues. Don’t plan to use your best month. Maybe look at your median month instead.

If you are retired, know the cash flow you can expect from all retirement sources. Whether you’re collecting social security, disability or other government funding and/or from your own private retirement plan, be sure that you are comfortable with the number.

Regardless of how well you budget for the road, there is always the temptation and sometimes just accidental overage in expenses that you’ll want to be able to account for down the road. If you know that you will have the funds to cover the overage, then you can live a little more peacefully as you travel.

7) Move as much of your financial life online as possible.

At this point in time, nearly all of your financial life can be lived through your online banking, shopping and bill-paying. So it’s likely that you’ve already moved everything online.

But if you haven’t, take the time to set up each account online. Then be sure you practice interacting with these accounts, whether it is manually paying a bill on a certain date or knowing exactly when the retirement pay will be posted.

Since you have consolidated your expenses, you should have a shortlist of items to move online. But be sure to do so as this will be particularly helpful when you are RVing full time.

8) Set up automatic payments.

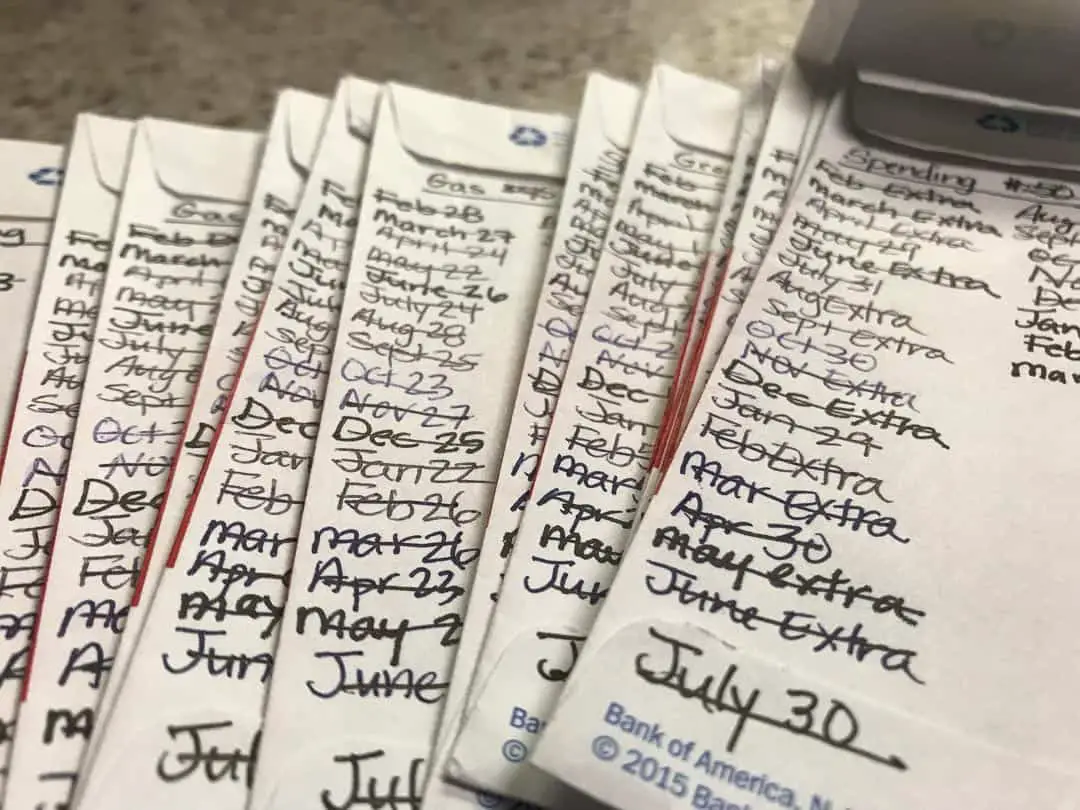

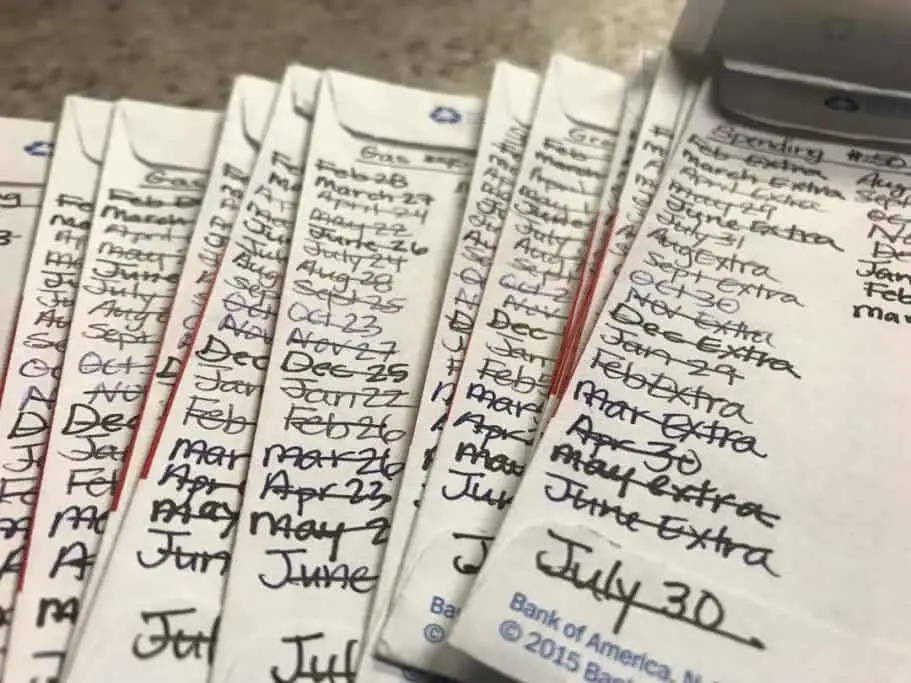

Anything automated is a blessing when you are RVing full time. While we have consolidated our expenses down to just a handful of bills, these are all automated and scheduled accordingly.

And because we always have $1,000 in our short-term emergency fund, in the event we forget to transfer funds around to cover scheduled payments we do not worry about an accidental overdraft.

Not all of our financial life is automatic. We still manually transfer money around before the end of one month to account for the next month’s bills.

But depending on your financial situation, you could virtually automate all of your financial life and then you can live on the road worry-free and enjoy life within the confines of your fair budget.

9) Know the costs of RVing.

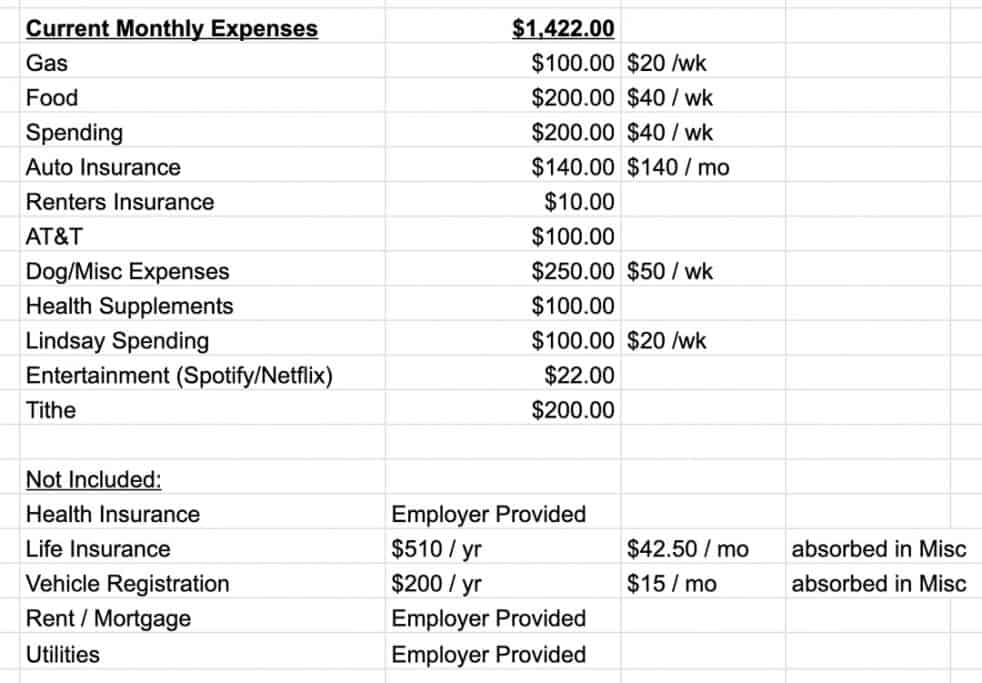

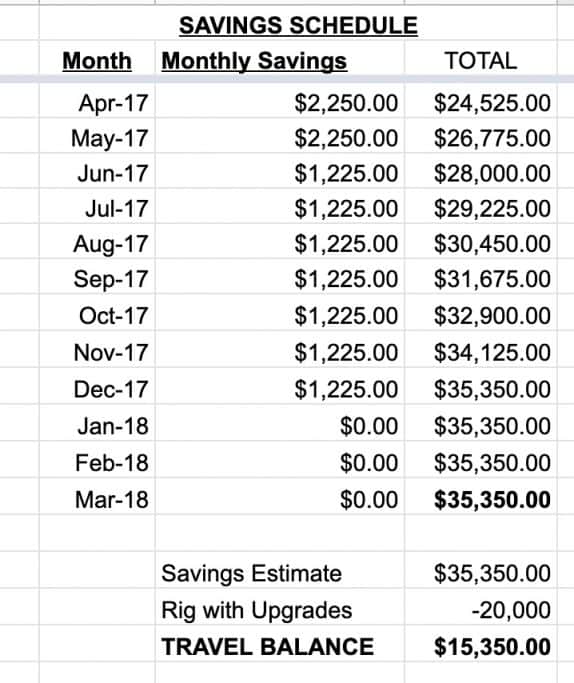

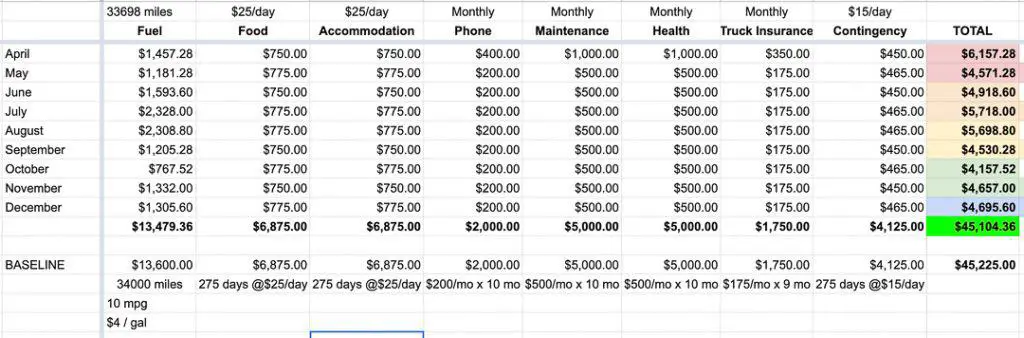

There are lots of examples of budgets for full-time RVers. We publish our full-time RV budget to give both a general sense of the expenses you can expect as well as day-to-day, dollar-for-dollar reporting of our monthly budget.

We live on less than $2,000 per month. But you may opt to have a larger or smaller budget according to your financial means. But be sure to factor in the total cost of ownership of your RV, including insurance, registration and regular maintenance.

Also, understanding the typical costs related to normal life in an RV can vary greatly. Campgrounds, for example, average between $30-$50 or more per night. Propane price fluctuates with the market but may be over $3 per gallon. And sometimes you may have to pay to dump your tanks at a dump station.

We were a little naive when we started RVing because we did not “practice” before we hit the road. We read somewhere that $25 per night would cover most campgrounds – but this proved to be inaccurate!

Do your research into your key costs of RVing to build a fair budget for yourself on the road.

10) Update banking information, credit cards and vehicle registration.

It’s embarrassing to swipe your credit card at a vendor only to realize that it expired and your new card is sitting in a mailbox wherever you may have forwarded your mail! Before you hit the road, renew anything that typically requires a home address or in-person visit.

Some states allow for multiple-year registration of vehicles. So extend it as long as possible to not have that concern when traveling. Update your drivers’ license, Passport, banking information and any other correspondence that will keep you from having to make an early return to your domicile and/or the headaches of a few extra steps to process the renewal.

We’ve been able to vote absentee (with some precise planning!), to renew our RV registration and even our passports all from the road. But it is much easier doing these things beforehand, whenever possible.

11) Have a plan for mail forwarding.

There are plenty of great mail-forwarding services out there if you do not have a close friend or family member who is willing and able to process your mail for you. We think Escapees has the best mail forwarding service. But we also rely on family to receive, open (or trash) and forward any important correspondence.

Although we simplified our life before we hit the road full-time, we still had some important correspondence that seemed to only come via “snail mail.” Documents related to filing our taxes, for instance, and other financial documents are forwarded to us from family members who sort through the junk mail.

But going through Escapees, or any other comparable service will ensure that you are able to receive any expected (or unexpected) important correspondence.

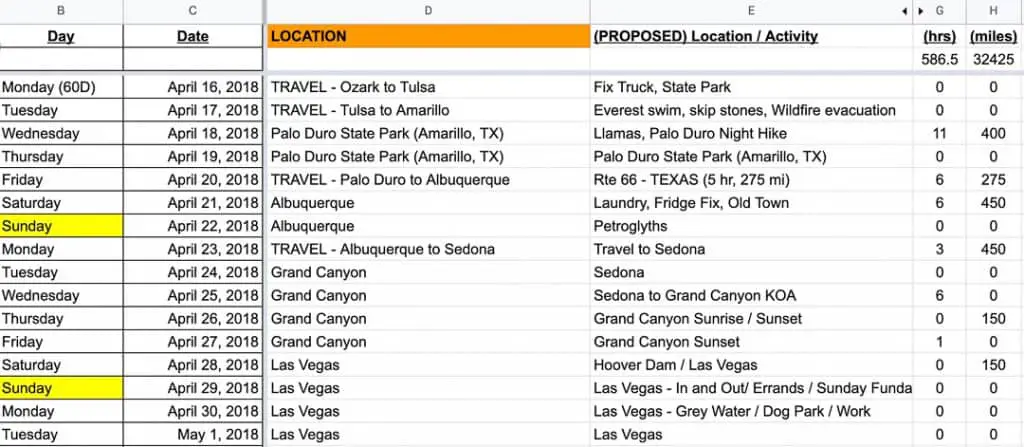

12) Set a loose itinerary to help you understand the costs related to travel.

To help you understand the costs of RVing, allow yourself to plan a hypothetical first week or two on the road. Let the devil come out in the details as you calculate the miles you will drive from point to point, and thus the potential fuel cost.

Check out the rates for various campgrounds along the way to understand those costs (and look for places you may be able to save on camping for free along the way).

Look into the various activities you would like to do along the way and any other potential opportunities to spend money so you have an idea of what this little trip would cost.

Then project that forward to get a rough idea of what a month on the road will cost. You may be surprised at how much, or little, it will cost you to actually get out on the road.

13) Insure yourself properly.

We believe that insurance, in general, serves a very important purpose in providing both peace of mind while traveling as well as the ability to protect your assets and loved ones. Depending on your life situation, you may already be well insured to cover virtually any part of life that can benefit from insurance.

These are the types of insurance we recommend you consider and establish before you hit the road:

- Life insurance – The foundation for your financial house, to protect your loved ones (not you)

- Health insurance – To provide peace of mind for receiving medical care as you travel

- Dental insurance – To keep up with your dental health on the road

- RV insurance – Required, of course, and designed to protect your life on the road

- Tow/Towed vehicle insurance (if applicable) – Only necessary if you have a secondary vehicle

- Homeowners/Renters insurance (as necessary) – Only necessary if you have a property at “home” or your RV insurance requires you to combine a renters insurance policy to cover the possessions in your RV

- Roadside Assistance – For added peace of mind, depending on the quality of your RV insurance

Each insurance serves its own purpose in protecting you and varies in whether you need it or not based on your particular financial situation.

14) Fix what you anticipate will break.

When something breaks on the road it is typically 3-4 times more expensive and more of a headache to solve. And while you can’t predict everything that will shake loose down a few miles of washboard road, there are some things you can pay particular attention to before you hit the road.

Our air conditioner, for instance, was on the fritz before we hit the road in our recently remodeled motorhome. Rather than find ourselves in a hot destination wanting to use the AC, only to find it inoperable, we decided to pay an expert to fix the AC before we hit the road.

Likewise, we are hyper-aware of regularly scheduled preventative maintenance such as oil changes and tire rotation and balance, and we recommend that you bring everything in your RV up to speck prior to driving your first mile in your full-time RVing life.

15) Reward yourself with something related to your RV.

As you prepare for full-time RV living you’ll find yourself overwhelmed at all of the things you need to do (especially if you’ve made it this far and realize there are potentially even MORE things to do!). But as you make progress in preparing for the road, reward yourself with something related to your RV.

Maybe you really knocked it out of the park coming in under budget for the month, having already become debt-free. You could set that money aside for something fun when you’re on the road – such as a tour, some tasty treats or whatever will keep you excited about the life you are dreaming of starting.

Don’t cast the vision so far out that you become disillusioned as to whether you will ever make it on the road. You could reward yourself with a nice weekend camping trip where you can test out new additions to your RV or destinations you always wanted to visit.

However you reward yourself for staying diligent in your discipline, we recommend that you make it related to your full-time RV lifestyle.

We used to “upgrade” our RV must-have list whenever we were particularly diligent about coming in under budget. If we knew we wanted, or needed, dishes for the RV, for instance, we might allow ourselves to buy the decorative ones we really, really wanted rather than just another bland set from the local big box store.

In this way, you are always moving toward your life on the road even though you might be months or even years from getting started!